Market data shape platforms and engagement

Sportsbooks and casino apps are built on data, tracking how real users interact to guide both interface updates and marketing campaigns. Consider this: in 2024, TGM Research reported that 77% of bettors mainly used mobile, outstripping every other format. That shift has pushed operators to chase immediacy and flexibility above all else. It’s not just about bets anymore; features like micro-betting and live “in-play” wagering rely on rapid data flows, keeping people logged in and active. The market’s scale surprises even seasoned insiders. Just in the US, legal wagers topped $93 billion in 2025. For operators like Vegastars online casino with a global online presence, actual usage data guides decisions around features such as custom promotions, interface changes, and support for new sports or events. Cloud-based analytics track engagement minute-by-minute, driving everything from bug fixes to the launch of entirely new sports. This nimble strategy helps sites react quickly, balancing regional preferences with larger, worldwide patterns.

Evolution of popular bets and player behaviors

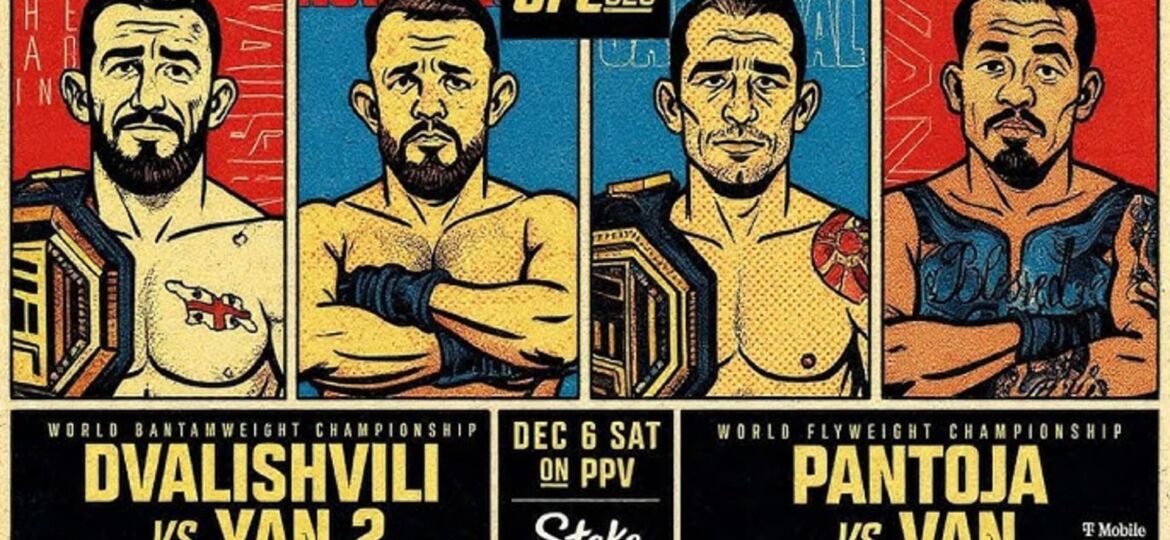

Football remains king, at least for now, making up more than a third of bets in 2024 based on Mordor Intelligence numbers. But that dominance is slowly being tested. The first three months of 2025 saw North American demand for Champions League data surge by more than double, indicating shifting interests. Basketball is primed for the fastest growth over the next few years, especially due to the rise of in-play and micro-bets that match the pace of the game. Meanwhile, unexpected data points keep surfacing: table tennis, for example, jumped to become the second most active sport for betting as of early 2025. Esports is charting its own course, fueled by players, on track for an 18.5% compound growth rate through 2033. The critical takeaway is that it’s not just what people watch, but how well sports adapt to rapid-fire in-play betting that drives volume. Operators are constantly tweaking their portfolios as new patterns show up, sometimes in a matter of months.

Personalization and security through analytics

Cookie-cutter user environments are fading out. Today, nearly every touchpoint, recommendations, promotions, odds, is tailored through analytics tools and artificial intelligence. Platforms use what they know about session history and betting habits to customize odds and bonus offers. With modern data systems, this all happens at a massive scale, and helps operators stand out while ticking every regulatory box. Live, real-time betting has already taken over more than half the industry. Algorithms track each play or goal, instantly shifting odds. Security is never sidelined. Operators deploy biometric verification, blockchain ledgers, and live risk-scoring to shut down fraud before it can cause damage. Mordor Intelligence suggests these tech investments are now as important as any marketing or customer acquisition effort. In the end, all this data work creates a more trustworthy space that matches what users now demand.

Shifting motivations and industry sustainability

Entertainment, not just financial benefit, is behind why more people return to betting and casino sites. By 2024, “thrill” and “immersion” became top reported reasons for logging in. With analytics, platforms now look to amplify enjoyment and flag high-engagement moments, often making small adjustments to maximize safe enjoyment. It’s a pivot: analytics aren’t just about chasing more users, but refining risk and building responsible systems for sustainable, long-term engagement. Data-driven deals for sports rights keep climbing. In this climate, every major move seems anchored in careful data strategy.

Responsible gambling remains a data priority

Responsible gambling stands on equal ground with every shiny new product launch. Operators watch for warning patterns using real-time analytics, jumping in to help before issues spiral. Limit tools, warnings, and exclusions all run on continuous tracking now. Industry groups push for total transparency and easy access to support. Data serves as a safety net helping guard every user’s well-being.